An NFT is proof of ownership for a unique digital item that can be bought and sold on the cryptocurrency marketplace. Here's what you need to know about buying and investing in crypto. (iStock)

Cryptocurrency has officially entered the mainstream after having a landmark year in 2021. About 1 in 6 Americans have invested in, traded or used crypto, according to Pew Research. The emerging financial tool has become so established, in fact, that a common cryptocurrency term has secured its spot in a popular online dictionary.

The Collins Dictionary word of the year is NFT, an abbreviation for a "non-fungible token" that's traded in the cryptocurrency blockchain. It beat out other timely phrases like "climate anxiety" and "hybrid working."

An NFT is a certificate that represents ownership of a digital asset, such as a work of art or collectible. Virtually any digital file can be transformed into an NFT, from GIFs and video clips to digital artworks and memes — former Twitter CEO Jack Dorsey's first tweet was sold as an NFT for $2.9 million, Reuters reported.

It's difficult to understand the value of an NFT without having a base knowledge of how cryptocurrencies work. Keep reading to learn more about crypto, including whether you should borrow a loan to invest. You can compare rates on a variety of financial products on Credible's online marketplace.

IS IT BETTER TO INVEST OR PAY OFF DEBT?

What is cryptocurrency and how does it work?

Cryptocurrency, also known as crypto, is a digital currency that you can use to purchase goods and services. Unlike traditional banking systems, cryptocurrency uses decentralized blockchain technology that securely manages and records transactions.

Among its enthusiastic supporters, crypto is seen as the currency of the future. Some of these investors see cryptocurrency as a long-term investment, betting on its eventual widespread use. Other speculators invest in crypto to cash in on its short-term gains, which can be challenging to predict.

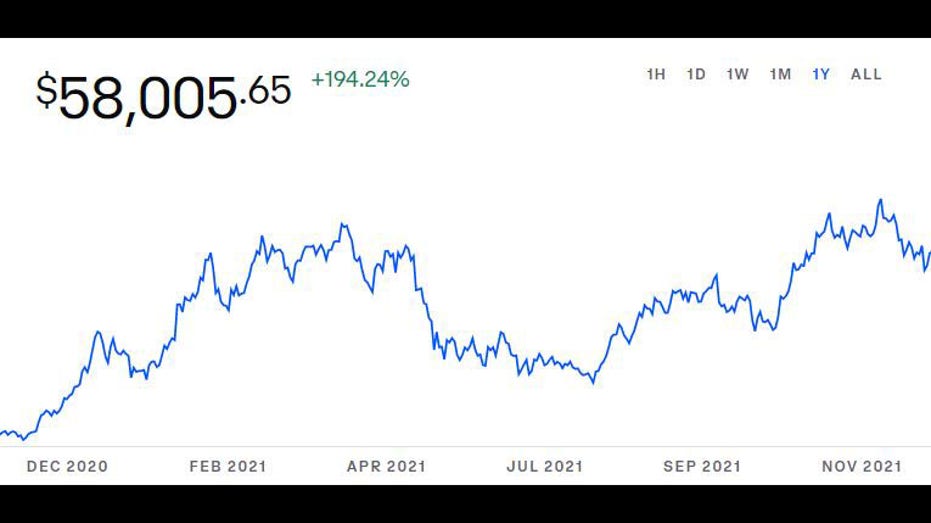

Take bitcoin (BTC) as an example. Since the token was first introduced in 2013, it has increased in value from around $100 to about $58,000 as of Nov. 30, according to the cryptocurrency exchange Coinbase. In the past year alone, the value of bitcoin has fluctuated between about $17,500 and $69,000.

Of course, bitcoin is just one of the thousands of cryptocurrencies currently on the market. The total value of all cryptocurrencies globally is $2.64 trillion, according to CryptoMarketCap, although bitcoin does make up the lion's share of the crypto market. These are the top 10 cryptocurrencies by total market value:

- Bitcoin ($1.1T)

- Ethereum ($553.9B)

- Binance Coin ($104.7B)

- Tether ($73.4B)

- Solana ($64.9B)

- Cardano ($53.3B)

- XRP ($48.2B)

- USD Coin ($38.7B)

- Polkadot ($37.9B)

- Dogecoin ($29.3B)

There's an important distinction between the cryptocurrencies listed above and NFTs. Fungible cryptocurrency tokens like bitcoin can be replaced by other fungible tokens. NFTs, on the other hand, are one-of-a-kind assets that can't be replaced, which lends to their overall resale value.

3 WAYS TO START BUILDING YOUR WEALTH EVEN WITH DEBT

Should you borrow money to invest in crypto?

With the unique growth potential offered by cryptocurrency, you may be wondering how you can get your hands on it. A recent Wall Street Journal report found that upstart lenders are offering loans backed by cryptocurrency holdings — which some borrowers are using to buy more cryptocurrency.

However, it's not recommended that you take out a loan to invest at all, let alone in a volatile asset like cryptocurrency. That's because it's highly unlikely that the money you gain by investing in crypto will offset the costs of borrowing a loan.

While your return on investment (ROI) is based solely on speculation, the interest cost of borrowing money is guaranteed. Use Credible's loan calculator to estimate borrowing costs and see this concept in action.

SHOULD I TAKE OUT A PERSONAL LOAN TO INVEST?

3 reasons to borrow money with long-term payoffs

Although borrowing money to buy crypto isn't advisable, taking out a loan with interest isn't always a bad investment. Here are a few examples of how loans can pay off in the form of long-term financial gains and savings:

- You're buying a home. Real estate is an asset that appreciates over time, and housing costs are typically worked into a borrower's budget regardless of whether they rent or buy. And since mortgage rates are relatively low, it's unlikely that you'll lose money buying a home as long as you borrow within your means and repay the loan strategically.

- You need to finance higher education. Many high-paying jobs require an advanced degree or certification. In some circumstances, borrowing student loans may pay off in the form of higher earnings down the road — although this isn't always the case.

- You're consolidating existing debt. Debt consolidation loans let you pay off high-interest credit card debt with better terms, such as a lower interest rate. A recent analysis predicts that well-qualified borrowers could save nearly $2,400 by consolidating their credit card debt. Just be mindful not to rack up more debt while you repay the loan amount.

Visit Credible to compare loan offers on a variety of financial products, including mortgages, private student loans and debt consolidation loans. It's free to compare rates, which can help ensure you're getting the lowest rate possible for your financial situation.

HOW TO INVEST FUTURE STIMULUS CHECKS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.

No comments:

Post a Comment